Online Money Growth

In the rapidly evolving digital age, the internet has transformed how we conduct financial transactions and manage money. The traditional economic landscape has given way to innovative online platforms and technologies, ushering in unprecedented opportunities for individuals and businesses. This article delves into the phenomenon of online money growth and explores the factors contributing to its success in the digital age.

Clearance Sales 15% Off on PCs, Accessories & More!

The Emergence of Online Money Growth

The rise of online money growth can be attributed to several key factors. Firstly, the increasing availability of high-speed internet and mobile connectivity has facilitated seamless financial transactions across the globe. With just a few taps on a smartphone, people can transfer funds, make purchases, and invest in a wide range of assets.

Furthermore, the proliferation of fintech startups has driven online money growth. These tech-savvy companies have disrupted traditional financial institutions by offering user-friendly and efficient digital financial services. From peer-to-peer lending to digital wallets, fintech has opened up new avenues for managing money.

Digital Payment Revolution

The digital age has significantly shifted from cash-based transactions to digital payments. Online payment platforms have gained widespread acceptance due to their convenience and security. Mobile payment apps, such as digital wallets and contactless payment methods, have revolutionized how we shop and conduct business.

E-commerce, too, has played a vital role in the growth of online money. With the rise of online marketplaces, businesses have expanded their reach beyond borders, allowing consumers to purchase goods and services virtually anywhere in the world.

Cryptocurrency and Decentralization

One of the most revolutionary aspects of online money growth is the advent of cryptocurrencies. Led by Bitcoin, cryptocurrencies have challenged the traditional financial system by operating on decentralized blockchain technology. The potential for borderless and censorship-resistant transactions has attracted a global community of users, leading to the proliferation of various cryptocurrencies.

While the volatility of cryptocurrencies has raised concerns, they have also opened up new investment opportunities for early adopters and tech-savvy investors. Additionally, the underlying blockchain technology has found applications beyond cryptocurrencies, promising enhanced security and transparency in various industries.

Financial Inclusion and Access

Online money growth has significantly increased financial inclusion, especially in underserved and remote areas. Digital banking services, microlending platforms, and mobile money solutions have provided millions of previously unbanked individuals access to financial tools and services.

Moreover, integrating financial services with social media platforms and messaging apps has further democratized money management. Users can now transact and manage their finances without traditional bank accounts, bridging the gap between the digital world and the financially marginalized.

Data-Driven Personalization

The digital age has allowed financial institutions and businesses to leverage data analytics for personalized services. Online platforms analyze user behavior and preferences to tailor financial products and offers that best suit individual needs. This data-driven approach enhances user experiences and helps detect and prevent fraud and identity theft.

However, balancing data collection and user privacy is crucial to maintain trust and confidence in online money services.

Embracing Security and Risk Mitigation

As online money growth continues gaining momentum, robust security measures’ importance cannot be overstated. With the convenience of digital transactions comes the potential risk of cyber threats, fraud, and scams. It is incumbent upon financial institutions, fintech companies, and individuals to adopt stringent security protocols to protect sensitive financial data.

Encryption technologies, multi-factor authentication, and biometric verification have become powerful tools for safeguarding online transactions. Additionally, educating users about online risks and promoting cyber hygiene practices are essential in building a secure digital financial ecosystem.

Regulatory Challenges and Compliance

The rapid growth of online money has posed regulatory challenges for governments and financial authorities worldwide. Striking a balance between fostering innovation and ensuring consumer protection has been a delicate task. Governments constantly revise and update financial regulations to adapt to the evolving digital landscape and prevent illicit economic activities.

Moreover, the emergence of cryptocurrencies has further complicated the regulatory landscape. Some countries have embraced cryptocurrencies and blockchain technology, while others have adopted a cautious approach, awaiting more clarity before formalizing their stance.

Globalization and Cross-Border Transactions

The digital age has brought the world closer, enabling seamless cross-border transactions and global trade. With online money growth, businesses can now access international markets without the complexities and limitations of traditional banking systems. This globalization of finance has also facilitated remittances, making it easier for individuals to send online money in the digital age to their families abroad.

However, navigating international regulations, exchange rates, and compliance requirements requires more work for businesses and individuals engaged in cross-border transactions. Collaborative efforts between governments and financial institutions are crucial to establishing a stable and transparent global financial ecosystem.

The Future of Online Money Growth

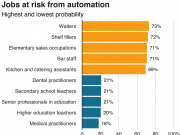

As technology continues to advance, the future of online money growth holds even more tremendous promise. Advancements in artificial intelligence (AI), machine learning, and big data analytics will further enhance the personalization and efficiency of financial services.

Central bank digital currencies (CBDCs) are also being explored by several countries, aiming to digitize traditional fiat currencies while retaining regulatory control. CBDCs could offer the benefits of both traditional currencies and cryptocurrencies, combining stability with the advantages of digital transactions.

Moreover, the Internet of Things (IoT) growth will likely introduce new opportunities for seamless and automated financial interactions. Intelligent devices and connected systems could enable autonomous transactions, eliminating manual intervention.

Conclusion

Online money growth in the digital age has ushered in a new era of financial empowerment, convenience, and accessibility. Technology has revolutionized how we manage, spend, and invest our money, from digital payments to cryptocurrencies and data-driven personalization. Nevertheless, as the financial landscape evolves, individuals and businesses must stay informed and responsibly adapt to these transformative changes. By embracing innovation and adhering to best practices, we can harness the full potential of online money growth for a brighter financial future.